Forex Mindset

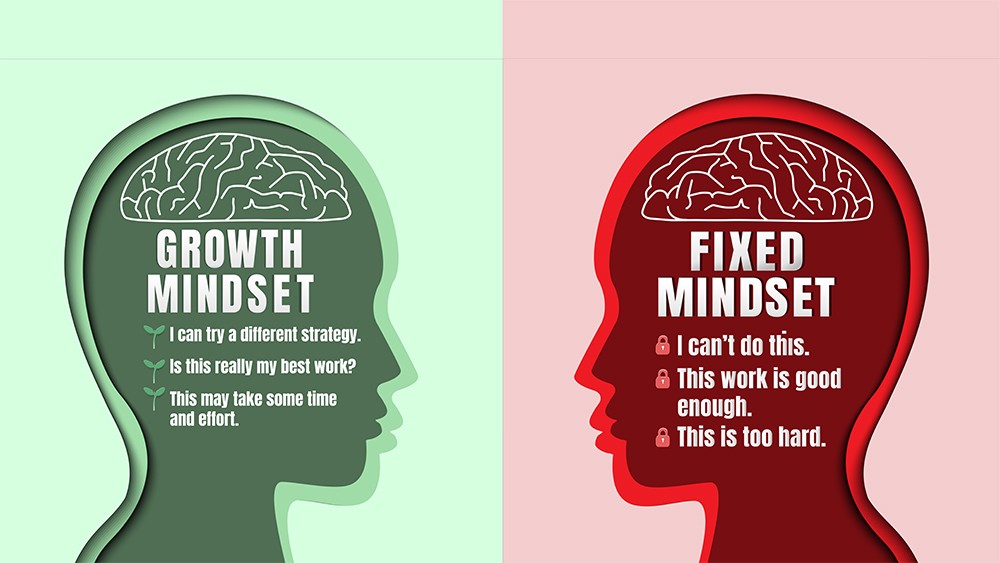

It would be an act of dishonesty to state that success in the Forex market solely relies upon the system or strategy you use. True consistency and your profitability are actually dependent upon your mindset and your trading independence!

However, websites and businesses endeavoring to sell an indicator or robot-based trading system will never tell you this. Why is this so? Because they want you to believe that it is possible to become profitable in the market by simply buying their product or service. So let’s have a little think. If such a system existed, one that was an autopilot moneymaking machine, would it not be a few billion dollars as opposed to not even a fraction of that?

The missing piece to the puzzle is your ability to balance your emotions with your mental processes. Failing to achieve this will result in you not being able to make money in the long-term or consistently.

Trading strategies are not universal. Each trader has distinct characteristics and therefore they may be more suited to one strategy yet not another. For instance, long term trading is convenient for traders with patience, whereas restless traders prefer intraday trading.

Whatever your preference, the key to success it to practice until you become perfect; as you would with any skill, shape it into a personal craft. A sure-fire way to becoming a better trader is to master just a few techniques, locate the set ups and determine exactly what your eyes are accustomed to find. Finally, only enter trades that fall in confluence with your preferred price action methodologies and plan.

Clarity and organization are two aspects that will positively affect your trading. By organized, we mean having a detailed trading plan and a thorough trading journal. Making use of these on a regular basis is a must. You need to think and treat Forex as though it is a business; not a trip to your local casino. Be calm and calculated in all of your interactions and you should have no problems in keeping the emotional trading demons at bay.

Trading the currency market is far from a team sport. This is a one-man band people! You may stumble across forums and groups on the Internet where ‘traders’ can pool their trading ideas together. However, you should avoid these because every trader works differently.

Trader A could be analysing a 5minute chart and aiming for 10pips, whilst trader B is analysing a daily chart aiming for 100pips. The point is each trader has different viewpoints affecting the way in which they trade.

You could be in a great position where you are ready to take advantage of your accurate analysis and a fantastic trade setup, until you view another trader’s chart in a forum, which is displaying an opposite bias. At this point the seed has been planted and you may lose confidence in yourself and your chart abilities. You will not find a professional profitable trader lurking in forums jumping from strategy to strategy.

Losing trades

Whether you are operating from your bedroom or on Wall Street, you will always encounter losses. You win some and you lose some; it is in the job description! A trader who places 100 trades could lose 20 trades in a row. Stay grounded and disciplined when it comes to keeping your risk tight.

Losing money

Unfortunately 90% of traders who lose money also lose their confidence. These are the traders who become entrapped into paying for bogus Forex services and some even go to the desperate lengths of allowing others to trade on their behalf. Again, we stress that there are individuals out there with not even two cents to their name who claim that they can help you. Do not be fooled by such false pretenses! Do not allow desperation to cloud your judgements, your will and drive is all that you need.